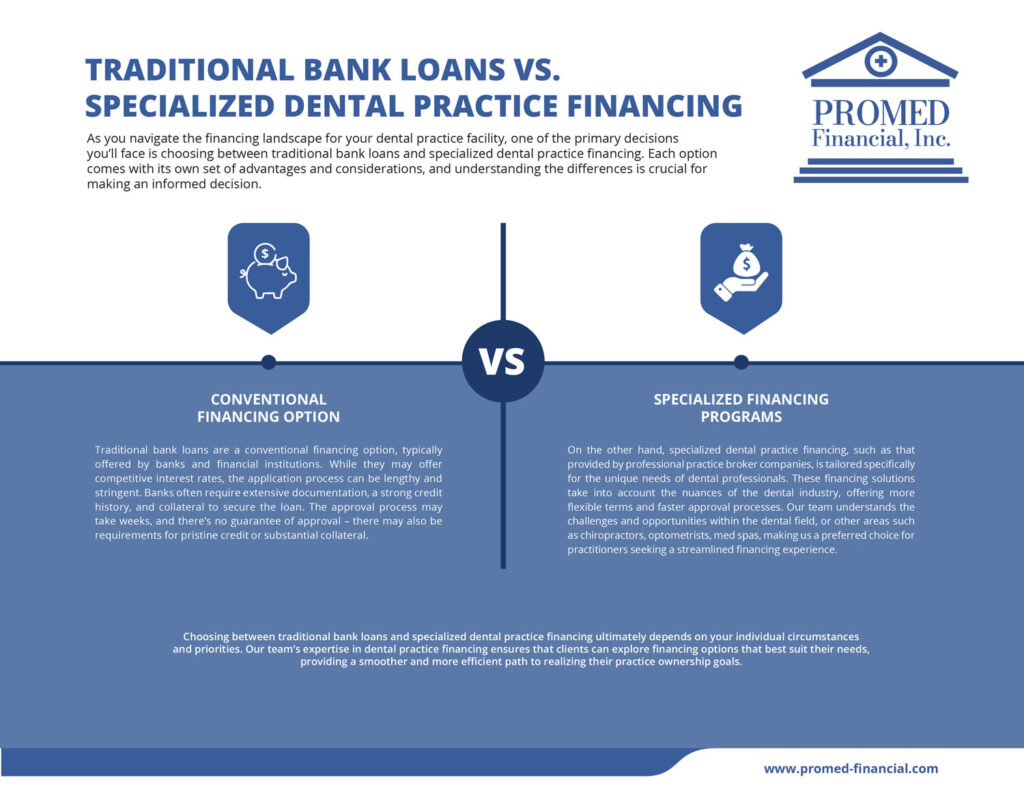

Traditional Bank Loans vs. Specialized Dental Practice Financing

Conventional Financing Option

Specialized Financing Programs

On the other hand, specialized dental practice financing, such as that provided by professional practice broker companies, is tailored specifically for the unique needs of dental professionals. These financing solutions take into account the nuances of the dental industry, offering more flexible terms and faster approval processes. Our team understands the challenges and opportunities within the dental field, or other areas such as chiropractors, optometrists, med spas, making us a preferred choice for practitioners seeking a streamlined financing experience.

Choosing between traditional bank loans and specialized dental practice financing ultimately depends on your individual circumstances and priorities. Our team’s expertise in dental practice financing ensures that clients can explore financing options that best suit their needs, providing a smoother and more efficient path to realizing their practice ownership goals.